ad valorem property tax florida

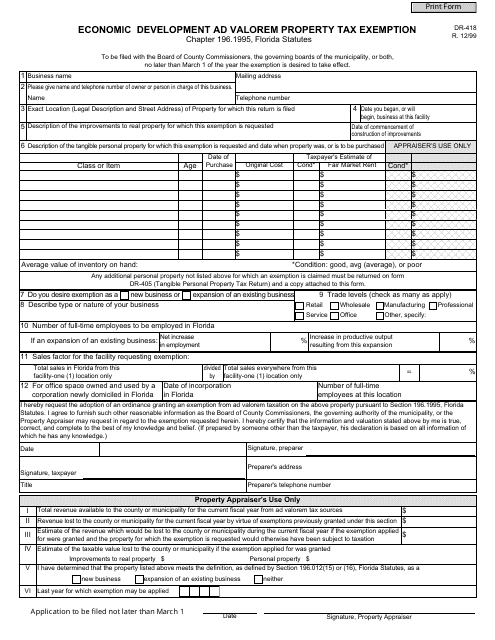

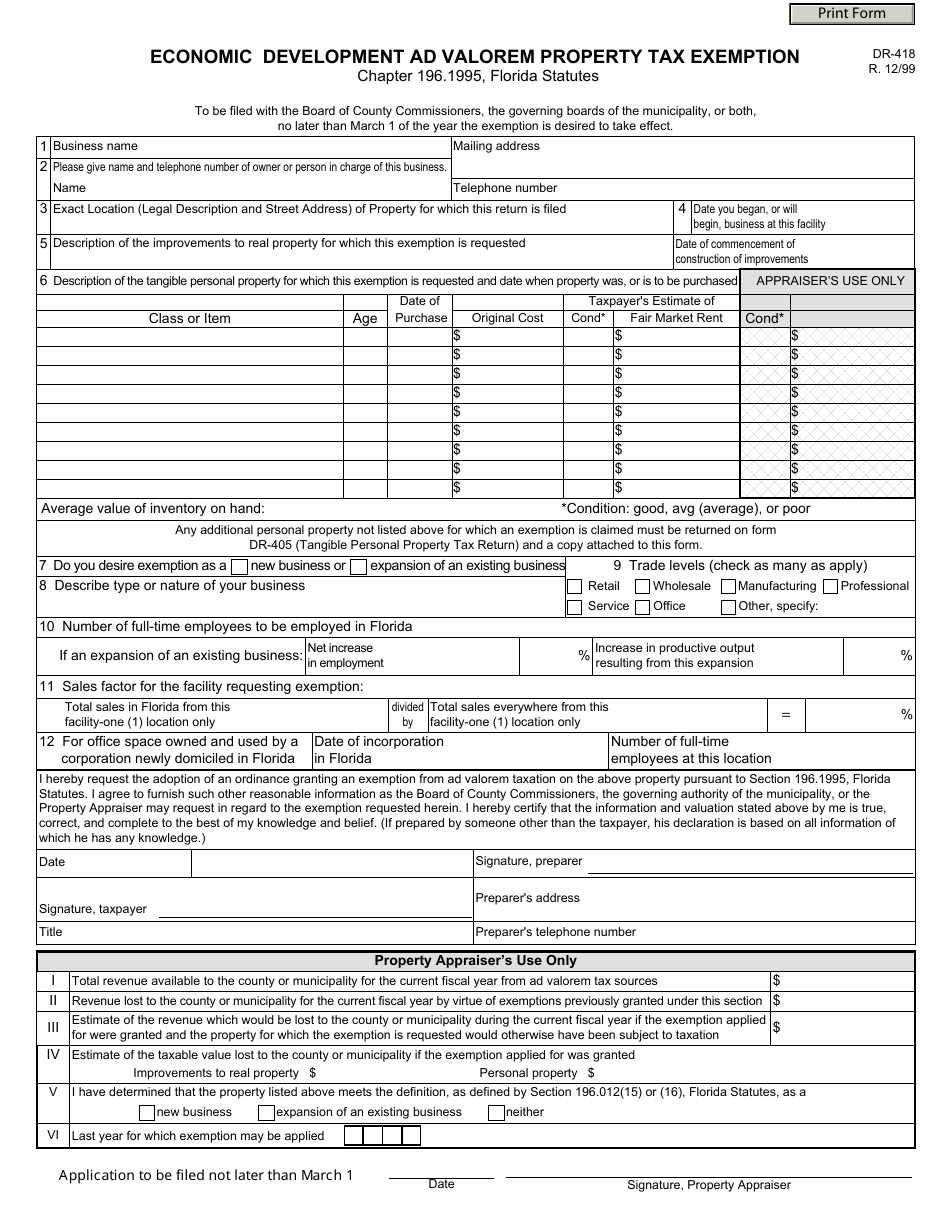

ECONOMIC DEVELOPMENT AD VALOREM PROPERTY TAX EXEMPTION Chapter 1961995 Florida Statutes To be filed with the Board of County Commissioners the governing boards of the municipality or both no later than March 1 of the year the exemption is desired to take effect. Services Hours General Office Hours 800 am.

A Guide To Your Property Tax Bill Alachua County Tax Collector

Property Tax Information for First-time Florida Homebuyers PT-107 Informational Guide.

. It also applies to structural additions to mobiles homes. A Levy means the imposition of a non-ad valorem assessment stated in terms of rates against all appropriately located property by a. Opry Mills Breakfast Restaurants.

Copies of the non-ad valorem tax roll and summary report are due December 15. 1299 section 1961995 FS PDF 446 KB DR-418C. PDF 106 KB Individual and Family Exemptions Taxpayer Guides.

They are levied annually. The tax roll describes each non-ad valorem assessment included on the property tax notice. Are Dental Implants Tax Deductible In Ireland.

Taxing Authorities and Non-Ad Valorem Districts. They are levied annually. The most common ad valorem taxes are property taxes levied on real estate.

Our attorneys have a wealth of knowledge and experience in all aspects of property tax law and appeals to help. Taxes usually increase along with the assessments subject to certain exemptions. Rennert Vogel Mandler Rodriguez has one of the largest and most successful ad valorem taxation departments in Florida.

Authorized by Florida Statute 1961995 this incentive provides an exemption of up to 10 years from the property taxes both real property taxes and tangible personal property taxes payable with respect. Real property is located in described geographic areas designated as parcels. Florida Department of Revenue.

The estimated tax amount using this calculator is based upon the average Millage Rate of 200131 mills or 200131 and not the millage rate for a specific property. Officer charged with the collection of ad valorem taxes levied by the county the school board any. Ad Valorem Taxes.

1973632 Uniform method for the levy collection and enforcement of non-ad valorem assessments. Property Tax Oversight Program. Floridas ad valorem statute allows tax exempt entities to be exempt from real property taxes when the property they own is being used to provide affordable rental housing as affordable housing is a charitable use.

Ad Download Or Email FL DR-418 More Fillable Forms Register and Subscribe Now. One valuable tax break which is available in a number of Florida counties and cities is the Economic Development Ad Valorem Tax Exemption. If a Florida Property Tax Appraiser denies your longstanding ad valorem tax exemption you may be able to get it back by challenging the denial in front of the Value Adjustment Board or in circuit court.

Ad Valorem Property Tax Florida. There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. Restaurants In Matthews Nc That Deliver.

Ad valorem means based on value. The greater the value the higher the assessment. Florida property taxes are relatively unique because.

In Florida property taxes and real estate taxes are also known as ad valorem taxes. Property tax can be one of the biggest single expense items for commercial properties. Tangible Personal Property Taxes are an ad valorem tax assessed against furniture fixtures and equipment located in businesses and rental property.

These tax statements are mailed out on or before November 1st of each year with the following discounts in effect for early payment. It includes land building fixtures and improvements to the land. A millage rate is one tenth of one percent which equates to 1 in taxes for every 1000 in home value.

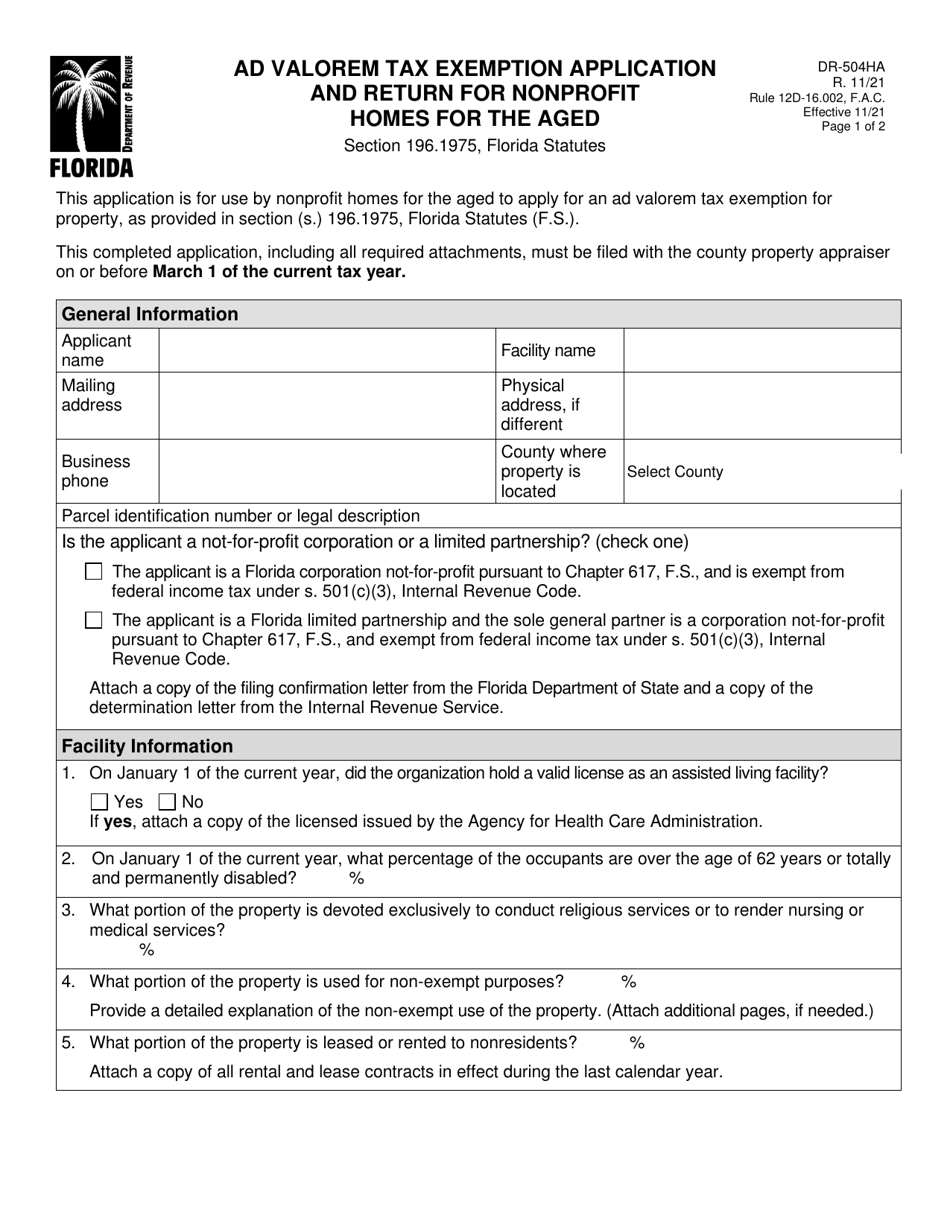

Ad Valorem taxes on real property and tangible personal property are collected by the Tax Collector on an annual basis beginning on November 1st for the calendar year January through December. It includes land building fixtures and improvements to the land. AD VALOREM TAX EXEMPTION Application APPLICATION AND RETURN Sections 196195 196196 196197 1961978.

Personal property for the purposes of ad valorem taxation shall be divided into four categories as follows. Economic Development Ad Valorem Property Tax Exemption R. 2 a 3 cap on the annual increase in the ad valorem tax value of the home.

Tax collectors are required by law to annually submit information to the Department of Revenue on non-ad valorem assessments collected on the property tax bill Notice of Taxes. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. TAX COLLECTIONS SALES AND LIENS.

FLORIDA COMMUNITY LAND TRUST INSTITUTE PRIMER A PUBLICATION OF THE FLORIDA HOUSING COALITION 62. Florida Property Tax Cycle. The collection of taxes as well as the assessment is in accordance with the rules and regulations of the Florida Department of Revenue and Florida Statutes.

Ad Valorem Taxes Real property is located in described geographic areas designated as parcels. 1 As used in this section. Majestic Life Church Service Times.

Learn more about Tangible Property Taxes Delinquent Taxes Taxes and assessments are due November 1 and are delinquent April 1. In Florida property taxes and real estate taxes are also known as ad valorem taxes. Soldier For Life Fort Campbell.

These charges are collected beginning November 1 each year. Taxes on all real estate and tangible personal property and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal.

This calculator can estimate the tax due when you buy a. 3 portability of an under-assessment the amount by which. Ad Valorem Taxes are taxes levied on real property and calculated using the property value and approved millage rates.

Check all that apply. 1962002 Florida Statutes This application is for ad valorem tax exemption under Chapter 196 Florida Statutes for organizations that are organized and operate for one or more of the following purposes. A Household goods means.

Application to be filed not later than March 1 DR-418 R. A permanent resident of Florida that owns his or her principal residence in Florida qualifies for 1 a 50000 exemption and an additional 50000 exemption if the owner is age 65 or older from the value of the property for ad valorem tax purposes. All owners of property shall be held to know that taxes are due and payable annually before April 1 st and are charged with the duty of ascertaining.

4 if paid in November 3 if paid in December 2 if paid in January 1 if paid in February. Income Tax Rate Indonesia. This estimator calculates the estimated.

Florida property taxes are relatively unique because.

Real Estate Property Tax Constitutional Tax Collector

Real Estate Taxes City Of Palm Coast Florida

Tax Prorations Explained For Florida Real Estate Closings Part 2

Do Not Miss Your Opportunity To Save It Is Due By March 1st The Florida Homestead Exemption Reduces The Taxable Va Miami Realtor Miami Real Estate Florida Law

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida

Form Dr 504ha Download Fillable Pdf Or Fill Online Ad Valorem Tax Exemption Application And Return For Nonprofit Homes For The Aged Florida Templateroller

2020 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Understanding Your Tax Notice Highlands County Tax Collector

Form Dr 418 Download Fillable Pdf Or Fill Online Economic Development Ad Valorem Property Tax Exemption Florida Templateroller

Erschliessungskosten Stadtwassernetz Cape Coral Florida

Free Form Dr 462 Application For Refund Of Ad Valorem Taxes Free Legal Forms Laws Com

Understanding Your Tax Bill Seminole County Tax Collector

Broward County Property Taxes What You May Not Know

An Investment In Knowledge Always Pays The Best Interest Floridatitlecompany Realestateattorney Www Marinatitle Com Investing Estate Lawyer Real Estate

2019 Florida Property Tax Appeal Deadlines Are Approaching Firstpointe Advisors Llc

Form Dr 462 Download Printable Pdf Or Fill Online Application For Refund Of Ad Valorem Taxes Florida Templateroller

Appealing Ad Valorem Tax Assessments Johnson Pope Bokor Ruppel Burns Llp

Estimating Florida Property Taxes For Canadians Bluehome Property Management